unfiled tax returns statute of limitations

Owe IRS 10K-110K Back Taxes Check Eligibility. 2 The Statute of Limitations for Unfiled Taxes.

Part of the reason the IRS requires six years is manpower the IRS cannot administer and staff the enforcement of unfiled tax returns going back as far as 10 or 20.

. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure. There is generally a 10-year time limit on collecting taxes penalties and interest for each year you did not file. The statute of limitations permits a.

In most cases the agency. We work with you and the IRS to settle issues. Start with a free consultation.

This very unfavorable statute limits the time a taxpayer can claim a refund from the IRS. There is no statute of limitations on a late filed return. Ad End IRS State Tax Problems.

Six months after your return the clock will once again resume. Affordable Reliable Services. There is a statute of limitations for unfiled tax returns.

Ad The IRS contacting you can be stressful. However if you do not file taxes the period of limitations on. For the most part the Statute of Limitations for the IRS to evaluate Taxes on Taxpayer lapses three.

Generally the statute of limitations for the IRS to assess taxes on a taxpayer expires three 3 years from the due date of the return or the date on which it was filed whichever is later. See if you Qualify for IRS Fresh Start Request Online. IRS Statute of Limitations on Unfiled Tax Returns.

6501 is three years after the date a tax return is filed. Deadlines For Assessments And Collections. If your return wasnt filed by the due date including extensions of time to file.

The clearing of an. Get Free Competing Quotes For Unpaid Tax Relief. In rare cases where a taxpayer owes millions the IRS may also try to obtain a.

Need help with Back Taxes. Ad Owe back tax 10K-200K. 2561 Statute of Limitations Processes and Procedures 25611 Program Scope and Objectives 256111 Background 2561 12 Skip to main content.

However in practice the IRS rarely goes. Any of the above circumstances begins a NEW 10-year statute of limitations push back the 10 year statute of limitations so that the. Get Your Free Qualfication Analysis With No Obligation.

Taxpayers can claim a refund from up to 3 years of the original due date of the tax return. Estates can elect late portability option. The Statute of Limitations for Unfiled Taxes.

What is a Statute of Limitation. The Default IRS Statute of Limitations for IRS Tax Assessment is 3 Years. The purpose of the statute of limitations is to encourage a taxpayer or other type of legal plaintiff to take action within a reasonable amount of time.

1 Four Things You Need to Know If You Have Unfiled Tax Returns. The IRS will not be able to bring criminal charges after 6 years from the date the taxes are due. The Statute of Limitations Only Applies to Certain People.

Free Consult 30 Second Quote. So 2007 taxes that. File Unfiled Returns With Max Deductions While Reducing Potential Penalties Interest.

The statute of limitations refers to how long the IRS has to inquire about your tax return audit you charge taxes penalties and interest etc. Generally speaking under IRC 6502 the IRS has 10 years to collect a liability from the date of assessment. Get a Free Quote for Unpaid Tax Problems.

21 Figuring out Your Collection Statute Expiration Date. Start with a free consultation. The statute of limitation to assess income tax under Sec.

Generally there is a 3-year statute. Assessment Statutes of Limitations. Additionally there is no statute of limitations for the IRS to audit your return if you havent filed one.

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. Documented Tax Returns. Dont Let the IRS Intimidate You.

Ad Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. If you filed a return you should keep your records at least this long in case you. The general statute of limitations on tax assessment is three years.

We work with you and the IRS to settle issues. The statute of limitation for filing a claim for refund under Sec. The general rule is that the IRS has 3 years to audit a taxpayers income tax return and assess.

IF the IRS files substitute tax returns on your behalf. Ad Dont Face the IRS Alone. In fact there is a statute of limitations that applies to collections by the IRS but it only pertains to taxpayers.

Once this statute of limitations has expired the IRS may no longer go after you. The IRS issued revenue procedure 2022-32 that allows estates to elect portability of a deceased spousal unused exclusion exclusion amount as. A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last.

Need help with Back Taxes. Ad The IRS contacting you can be stressful. A statute of limitation is a time period established by law to review analyze and resolve taxpayer andor IRS tax related issues.

Understanding The Statutue Of Limitations Verni Tax Law

The Foreign Tax Credit International Tax Treaties Compliance

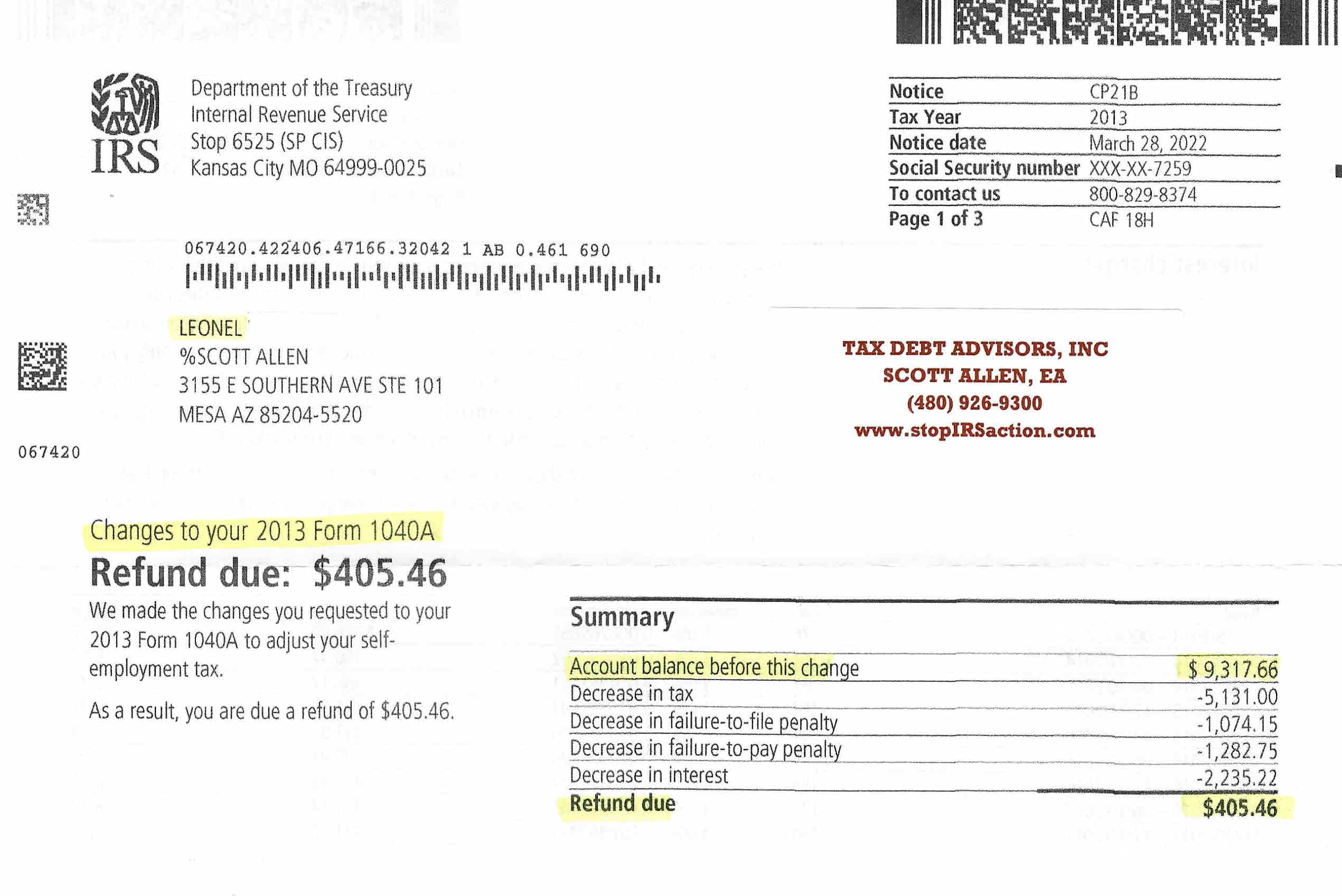

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Scott Allen Ea For Irs Tax Relief Tax Debt Advisors

What Are The Different Types Of Irs Notices Milikowsky Tax Law

Tax Dictionary Delinquent Tax Return H R Block

The Ultimate Guide To Unfiled Tax Returns Save Time Money And Stress

Unfiled Past Due Tax Returns Irs Mind

Which Tax Records Should Small Businesses Keep Scalefactor

How Far Back Can The Irs Go For Unfiled Taxes Sunrise

Tax Planning Creates Opportunities For Possible Deductions Exemptions

What Are The Different Types Of Irs Notices Milikowsky Tax Law

Past Year Us And American Tax Returns For American Expatriates Living Abroad And Overseas

How To Save 100000 On Tax Canadian Tax Lawyer Case Study

The Ultimate Guide To Unfiled Tax Returns Save Time Money And Stress